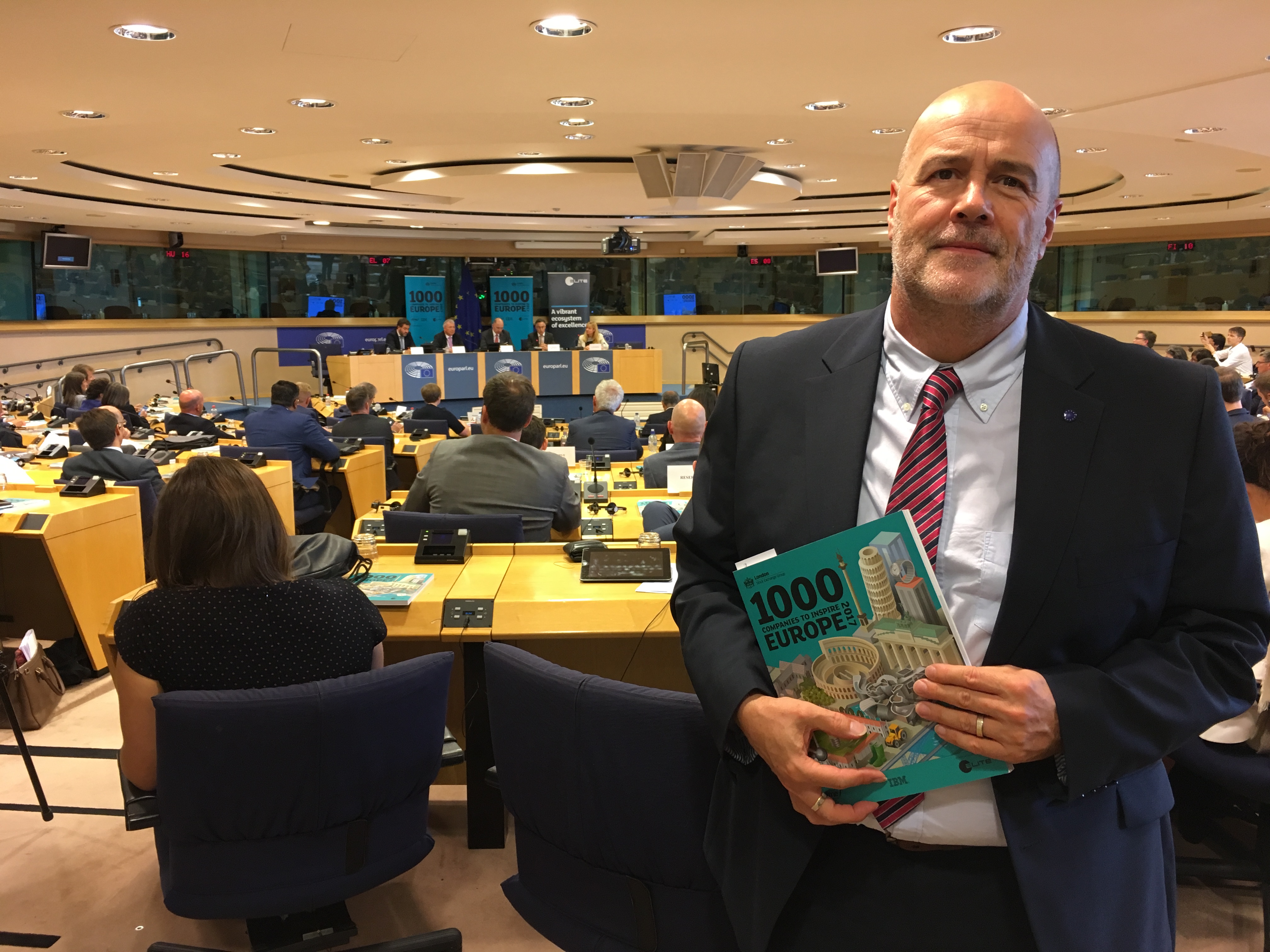

The London Stock Exchange today launched the 2017 edition of its ‘1000 Companies to Inspire Europe’ report. The overall tone, both in the report and at the accompanying launch event that I attended at the European Parliament, is positive for both the EU and the UK. There are 23 million small and medium-sized enterprises (SMEs) across Europe, and the thousand chosen to be featured in the report have boosted job creation by 43% over the last two years, and have collectively grown by over 100% over the last three years. Companies like these are the engines that drive the European economy.

And I’m pleased to say that the UK, and the South East, is doing particularly well. Of the thousand companies highlighted, 170 of them are from the UK - more than from any other country except Germany.

The report acknowledges that there is still much more to do. For a start, many of these smaller firms could grow and take on more staff if they were better able to access equity and risk finance (if they could sell shares on stock exchanges, or attract venture capital and private investors) rather than having to rely on bank loans and other forms of debt.

This is something the EU is actively trying to address through its ‘capital markets union’ project, aimed at removing the barriers to finance and meaning that investors and companies from right across the continent can make use of a genuine single market for capital. It is an ambitious project, and one that could be game-changing.

Unfortunately for British SMEs, of course, just as the EU is making real progress in this area, the UK is going to turn its back and walk away. And if those who are pushing for a “Hard Brexit” get their way, we’ll end up on the outside of the single market and life will become more and more difficult for our businesses.

That’s partly because of the risk of having to pay tariffs (which EU membership exempts us from), but also - and perhaps more importantly - because of the significant bureaucratic burdens that companies have to comply with when you are on the outside of a market and looking in. One of the supreme ironies of the Brexit vote is that leaving the EU is going to mean a massive increase in red tape for many of our businesses. As a former director of several successful SMEs which traded with EU states, I warned of this before and during the EU referendum and contributors at today's event supported the view.

These kind of burdens tend to hit smaller businesses hardest, because they cannot just absorb the extra costs in the way that their giant competitors can. So while the EU is doing all it can to make life easier for small businesses - making it easier for them to access finance, dedicating specific sources of funding to SMEs (which I am currently fighting to help protect as part of the EU’s Budget for 2018) - the UK is going in the opposite direction. A country which used to pride itself on being a good place to do business is actually in the process of throwing up barriers and cutting off sources of funding, all to satisfy an increasingly deranged group of Tory backbenchers who seem to have lost touch entirely with one of their traditional audiences.

This all matters. A whopping 99% of British businesses are SMEs. Three in every five private sector workers are employed by an SME. Successful small companies frequently pay well, take care of their employees and pay their fair share of tax - which is more than can be said for quite a few multinationals. If leaving the EU is about to make it harder for them to do business - and, and as one speaker at the LSE event pointed out, Brexit is a number one concern for SMEs - then we will all suffer the consequences.